Payday Loans vs Installment Loans: Which is the Right Choice for You?

What is the Difference Between Payday Loans and Installment Loans?

When you need a loan but can’t get one from your bank, financial institution, or friend, you may want to consider getting an installment loan. These are generally short-term loans intended to tide you over until you can get your finances back on track. This makes them a good option for people with short-term needs like bills that have to be paid immediately. On the other hand, if you happen to be looking for a long-term solution for your money worries, then getting an installment loan may not be the best choice. This is because these loans often require you to make regular payments over a period of months or years in order to repay your debt. In contrast, payday loans are short-term cash loans given by banks and other financial institutions without requiring you to make regular payments for up to three months. You must, however, repay the money once the term has ended. In this article, we take a quick look at what each type of loan is good for and which one is the better choice for you. If you don’t know much about installment loans or payday loans, then don’t worry – we’re here to help!

What is an Installment Loan?

An installment loan is a short-term loan obtained from a financial institution against your full debt. An installment loan is a short-term loan that you make to tide you over until you can get your finances back on track. It is typically repaid at the end of each month. These types of loans are great for short-term needs like bills that have to be paid immediately. They are also known as cash advance loans or cash-out loans.

What is a Payday Loan?

A payday loan is a short-term loan obtained from a credit union, bank, or other financial institution. Payday loans are short-term cash loans given by banks and other financial institutions to customers with short-term financial needs like bills that have to be paid right away. You can get a cash loan that meets your immediate needs, or a loan with a reduced interest rate if you have a history of bad financial habits. Payday loans have been around since the 1970s when they were known as sketchy loans. The name was changed to reflect the fact that these were not cash loans but short-term borrowings from financial institutions. These loans are repaid at the end of each month.

How does Installment Loan Works?

An installment loan is a specific type of loan that is obtained from a financial institution against a borrower’s full debt. The loan is secured by the borrower’s property and interest will be charged on the balance if it is not paid within a set time. There are many different types of loans available from financial institutions, including cash advances, loans, and mortgages. A cash advance is a short-term loan obtained from a lender that must be repaid with cash. A loan is generally a long-term debt and has to be repaid with interest. A mortgage is a long-term debt that must be repaid with interest.

Here’s how Installment Loan works: You make a request for an installment loan at your local financial institution. The loan payment is due every other day, usually between the hours of 9 am and 5 pm. If you miss a payment, your account is automatically charged and you’re stuck with a high monthly fee until you pay off your balance. You can also call your local financial institution and speak to a loan representative to arrange an installment loan.

How do Payday Loans work?

Similar to an installment loan is the payday loan. However, unlike an installment loan, you can get a payday loan that is cash-only and without a minimum payment. These loans are also cash-only, and the borrower is expected to pay them back at the end of each month. Costs of Payday Loans and Repayment Timescales When you compare the costs of a payday loan and payoff, it becomes clear that you get less flexibility with the latter. The length of time it takes to repay a payday loan is also different from the length of time it takes to pay off a regular loan. Payday loans usually carry higher interest rates than other short-term loans, and some banks and credit unions have a minimum loan amount that you must pay before you can get a loan.

Pros of getting an Installment Loan

flexibility – You can choose to repay the loan in one lump sum or over a period of time

– Some loans have lower interest rates than others

– A limited repayment plan

– With an installment loan, you make monthly payments for a shorter period of time

– Can help with short-term money needs

– These loans are often cheaper than cash advances

– You don’t have to worry about paying bills or repayments

– You can choose to repay the loan in one lump sum or over a period of time

– Some loans have lower interest rates than others

Cons of getting a Payday Loan

Excessive debt – Payday loans can lead to an accumulation of debt. If you make regular payments even when you aren’t in need of them, you’re likely to end up with a higher credit rating. This will make it harder to get other loans and will increase your monthly costs.

Imposters – Be careful when you’re applying for a loan and choose your lender carefully. Some lenders will charge an interest rate that’s higher than the rate you would pay at a normal lending institution. This is known as an impostor fee and is charged by the lender. Be wary of these if you’re not able to pay off your loan in full.

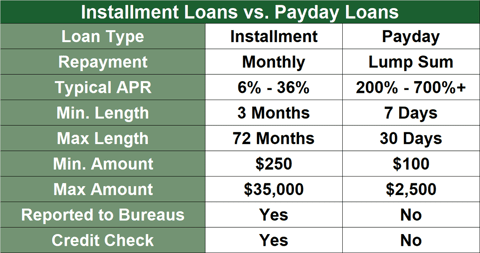

Difference Between Payday Loans and Installment Loans

The difference between Payday Loans and Installment Loans is represented in the image below.

Get the Lowest Interest Rate on a Payday Loan

If you have a history of bad financial habits and need a short-term loan to tide you over until you can get your finances back on track, a payday loan may be right for you. You can get the best rate on a cash-out loan, which is basically a cash loan given by a bank or credit union. However, you’ll have to pay a fee to borrow the money. Payday loans are attractive to people with bad credit, as they don’t have to pay an annual fee or a percentage of the amount borrowed.

Get Your Cash Immediately with a Payday Loan

The best option for people with bad credit is to get a cash advance loan from a lender with a reputation for providing honest and reliable services. These include banks and credit unions. Many of them will give you a cash loan with a small fee, usually between $30 and $50.

Conclusion

There are many different types of loans available, and it’s important to understand what benefits each has before deciding which one to use for your needs. There are advantages to each type of loan, so it’s up to you to decide which one is right for you. The best option for getting a loan is either an installment loan or a payday loan. Both have their advantages and disadvantages, so you should carefully consider which one is right for you.